The world is facing a new economic threat – not a recession or financial crisis, but a super-powered wave of Chinese exports. Over the past four years, Chinese state banks have directed $1.9 trillion into industrial enterprise financing. These funds have become fuel for building new factories, modernizing production, mass automation, and rapid export growth, which are already impacting global markets.

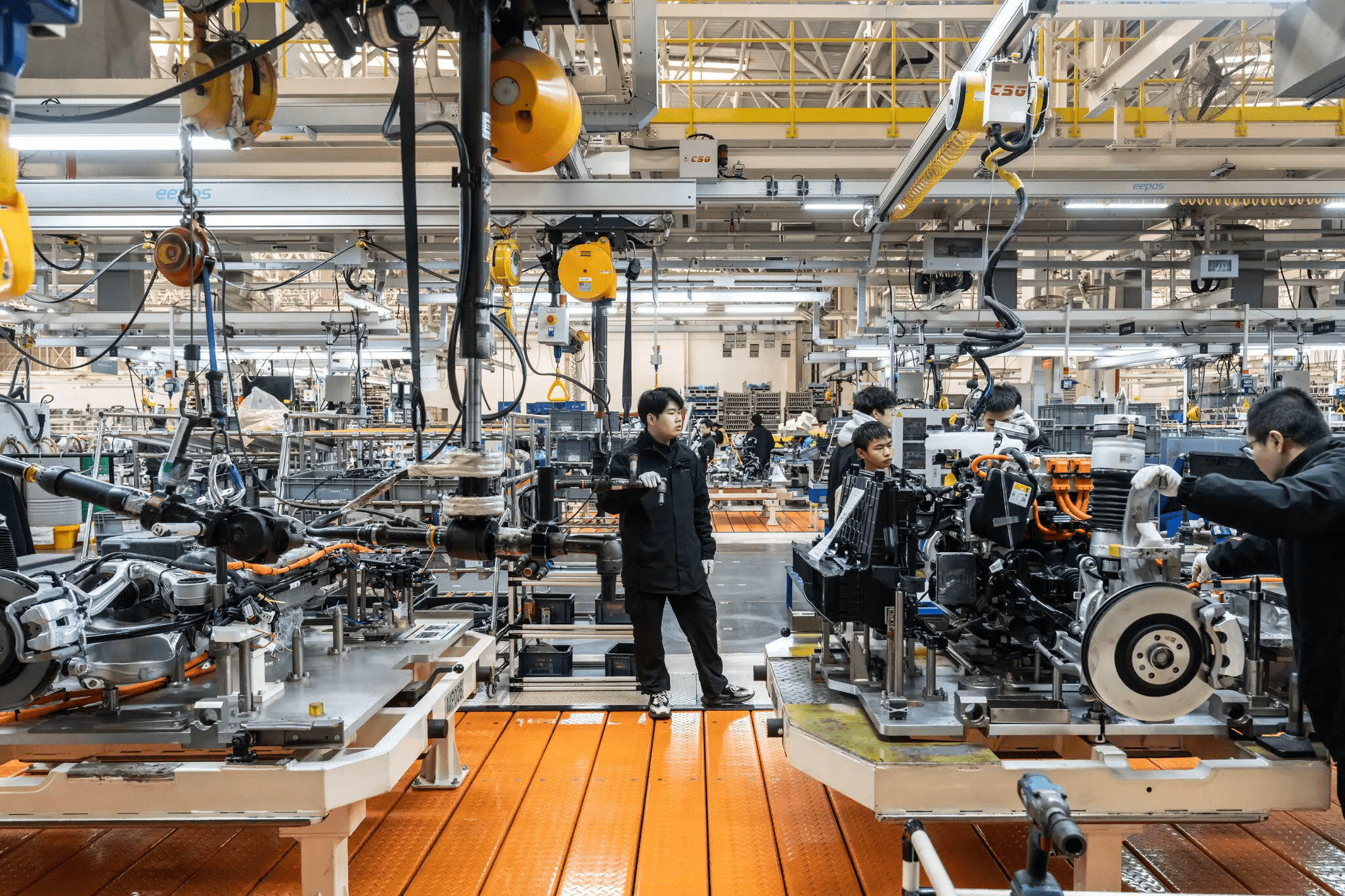

Instead of skyscrapers dominating cityscapes before the housing market crash, today on the outskirts of Chinese cities, factories equipped with robots are rising. China is not only increasing production volumes – it is investing in research, development, artificial intelligence, and its own industrial know-how.

BYD, Zeekr, and Huawei — symbols of a new industrial era

The electric vehicle giant BYD is building factories that surpass the scale of Volkswagen’s former largest car plant in Wolfsburg. While Zeekr installs hundreds of new robots in its production facilities, Huawei is opening a research center in Shanghai with 35,000 engineers — ten times the size of Google’s headquarters.

It’s no surprise that China’s exports in 2023 increased by 13.3%, and in 2024 — by another 17.3%. These figures are impressive and simultaneously alarming — because such growth is achieved through significant government subsidies, dumping, and low domestic demand.

World reaction: tariffs, panic, and searching for solutions

Countries are reacting ambiguously. The European Union, the USA, Brazil, and Indonesia are introducing or strengthening customs restrictions. President Trump announced a new series of high tariffs, causing stock markets in Asia to fall. Chinese television responded with a harsh statement against the "hegemonistic economic policy of the USA".

However, history does not repeat literally. This time, Chinese companies blocked from the American market are actively expanding into new territories. For example, the share of Chinese cars in Mexico increased from 0.3% in 2017 to over 20% in 2024. Meanwhile, China is expanding its petrochemical production and exports of plastics, tires, polyester, and other industrial goods.

The Chinese model: cheaper, faster, larger-scale

China applies a unique development model: when domestic demand weakens, it is replaced by exports. After the housing market collapse, authorities redirected credit from apartment construction to industrial production. The decline in domestic consumption is compensated by export stimulation, allowing millions of jobs to be maintained.

However, problems remain. The social protection system is extremely weak — the state pension amounts to only $20 per month after a recent "increase" of three dollars. Economists are calling for the government to strengthen the domestic market through raising social standards. But Beijing currently prefers new investments in logistics, infrastructure, and factory modernization.

Is the world ready for a new industrial leader?

China already controls over 32% of global industrial production, leaving behind the USA, Germany, Japan, South Korea, and the United Kingdom combined. And this percentage is growing every month.

The question remains open: can the world withstand such scale of economic expansion? Will small and medium-sized producers survive the competition? And will leaders of the democratic world find effective and balanced responses that do not lead to new global conflicts?