Economics

Economics

28

Ohio Citizens Rise: The Fight to Abolish Property Taxes Gains Momentum

CLEVELAND, Ohio — In a state where property taxes have become an unaffordable burden for many homeowners, a civic movement is gaining momentum, challenging the long-standing tax system. A group of residents led by Lakewood activist Bet Blackmar is pushing to include an amendment to the Ohio Constitution on the November ballot to abolish property taxes. For thousands of citizens like Marlen Homan from Cleveland, this is more than just a political initiative — it's a matter of survival.

"When you live on Social Security, every extra dollar on your tax bill is a hit," says Homan, her voice trembling with frustration. Her property taxes have risen to record highs, and she is not alone. Reassessments and voter-approved tax increases have forced many Ohio residents to consider selling their homes — or even leaving them behind because they cannot afford to pay. "Where does this end?" Homan asks, and this question echoes across the state.

The organization "Citizens for Property Tax Reform," led by Blackmar, has become the voice of those feeling abandoned by lawmakers. "Nothing is being done — absolutely nothing," she declares passionately, reflecting the frustration of many. Her movement is not just a protest but an attempt to return power to the people. The amendment they are advocating for could radically change Ohio's fiscal landscape, but its path to the ballot is fraught with obstacles.

State legislators do not seem eager to address the issue. House Speaker Matt Huffman has tasked Republican David Thomas with drafting a bill to cut property taxes but urges patience. "We want to get this right, without rushing decisions," Thomas says, acknowledging citizens' concerns but avoiding specific promises. Insider reports indicate behind-the-scenes discussions in Capitol circles about the political risks of such reforms, as property taxes underpin funding for local schools, police, and other services.

Governor Mike DeWine has expressed serious concerns about the consequences of eliminating taxes. "I understand people's frustrations, but they need to explain how schools, police, and everything else we value in Ohio will be financed," he stated, calling it a "moral obligation." In some areas, such as Cleveland, up to 80% of school budgets rely on property taxes. Without them, the education system could be on the brink of collapse.

However, Blackmar remains undeterred. She proposes alternative solutions, such as a School District Income Tax (SDIT), which could offset losses. "There are other ways," she insists. "We're not saying schools should be left unfunded. We say the current system is unfair." Her movement is not only about abolishing taxes but also about restoring the voice of the people. "It's a reprieve of power to the people," Blackmar declares, and her words resonate with those tired of waiting for government action.

On Wednesday, the Ohio Secretary of State’s Office will decide whether to allow "Citizens for Reform" to begin collecting signatures to place the amendment on the ballot. This moment could be pivotal for the movement, which has already attracted thousands of supporters. However, even if the initiative qualifies for a vote, success is not guaranteed. Polls conducted by local analysts show that many voters support the idea of tax cuts but fear the impact on local communities.

For Marlen Homan and other Ohio homeowners, this fight is more than politics. It’s about dignity, the right to stay in their own homes, and faith that the system can work for the people and not against them. As the state stands at a crossroads, Blackmar’s movement reminds us: when legislators delay, citizens are ready to take matters into their own hands. Will they be heard in Columbus — or will Ohio have to go through a referendum to change the game rules? Time will tell.

15.05.2025

Economics

19

TD Bank Announces Closure of 38 Branches in the US: Digital Transformation or Fallout from a Scandal?

In June 2025, TD Bank, one of the largest banks in the USA, plans to close 38 branches in 10 states and the District of Columbia. This decision, which covers less than 4% of the bank's network, is part of an operational optimization strategy and adaptation to changes in customer behavior.

Reasons for the closure

TD Bank explains the branch closures as "routine business reviews," considering traffic, customer needs, product utilization, and community characteristics. However, this decision also coincides with the consequences of a fine exceeding $3 billion imposed by the U.S. Department of Justice in 2024 for violations of anti-money laundering laws. Fast Company

Impact on customers

The branch closures will affect customers in states such as Connecticut, Florida, Maine, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, South Carolina, Virginia, and the District of Columbia. Among them are branches in New York on Park Avenue and Lexington Avenue, as well as in cities like Miami Beach, Philadelphia, and Boston. AS USA

The bank assures that customers will be able to continue banking services through other channels, including online banking and mobile apps. However, for some customers, especially the elderly and those without access to digital technologies, this may pose a challenge.

The future of TD Bank

Despite the closures, TD Bank plans to open new branches in underserved communities such as Brighton Beach in Brooklyn and Nubian Square in Boston. The bank also announced leadership changes, appointing new leaders for retail banking in the USA. The US SunBanking News and Analysis | Banking Dive

These steps indicate TD Bank's effort to adapt to the new realities of the financial sector, focusing on digital solutions and efficiency, while attempting to maintain customer trust after recent scandals.

09.05.2025

Economics

85

New York Under Pressure: How Trump's Tariff Policy Affects the Economy of the Mega-City and Neighboring States

One hundred days after Donald Trump's return to the White House, the economic policies of his administration are already noticeably affecting residents of New York and neighboring states. The aggressive tariff strategy aimed at reducing the trade deficit and bringing manufacturing back to the U.S. raises concerns among entrepreneurs, economists, and consumers.

Tariffs and their impact on consumers

According to data from the Organization for Economic Cooperation and Development (OECD), new tariffs could cost the average American household an additional $3,800 annually. This is especially felt by residents of New York, where the cost of living is already among the highest in the country.

Jeff Kwan, owner of Canal Sound and Light, notes that prices for imported goods have nearly doubled. "Something like this product used to sell for $599, and now — for $1,049," Kwan says. He doubts that consumers are willing to pay such amounts for electronics.

Impact on business and investments

Entrepreneurs and investors are concerned about the instability caused by tariff policies. Goldman Sachs CEO David Solomon warns that uncertainty forces company leaders to cut costs and delay investments. "This negatively affects U.S. economic growth," Solomon notes.

Moreover, New York, as a major trading hub, feels the consequences in the form of reduced trade volumes with Canada and Mexico. In 2023, trade between New York and Canada amounted to $44 billion, and new tariffs could significantly decrease this figure.

Tourism under threat

The tourism industry in New York also feels the pressure. Julie Coker, president of the New York Department of Tourism and Conventions, expresses concerns that tariffs could deter tourists who spend $51 billion annually in the city. "Their spending is very important to us because they not only create jobs for New Yorkers but also spend money in restaurants or attractions," Coker says.

Market reaction

The stock market responded to tariff policies with a significant decline. The S&P 500 index fell by 7.3% during the first 100 days of Trump’s presidency, marking the worst start to a presidential term since the 1970s. This raises concerns among investors and economists about a potential recession.

Conclusion

The tariff policy of the Trump administration has a significant impact on the economy of New York and neighboring states. Rising prices, reduced investments, and consumer concerns create challenges for businesses and residents in the region. While the administration promises long-term benefits, the short-term consequences are already tangible at the local level.

07.05.2025

Economics

372

Trump's Tariff Shock: Global Markets Fall, Investors in Panic

Against the backdrop of President Donald Trump's new tariff policy, global financial markets are experiencing their deepest weekly plunge since the COVID-19 pandemic. The S&P 500 index fell by 9.1%, marking the worst result since March 2020. Investors reacted quickly and harshly, expressing distrust in the radical changes to the US economic course.

Indices decline: economy on the brink

On Friday, the American S&P 500 index lost immediately 6% and ended the week with a total decline of 9.1%. The Nasdaq Composite dropped nearly 23% from its December peak, and the Russell 2000 small-cap index lost a quarter of its value from the November high. Such indicators point to an approaching bear market — a decline of more than 20% from the previous maximum, which is a signal of deep investor pessimism.

"The market shows a big thumbs down to this tariff policy," — noted veteran analyst Ed Yardeni.

Political decision, not an economic crisis

This time, the cause of financial turmoil was not global epidemics or bank failures, but the president's decision. Announcements of massive tariffs on imported goods triggered a global investment shock. Analysts cannot recall a similar case where a presidential decision so quickly caused a market collapse. The situation is compared with the disastrous budget initiative of British Prime Minister Liz Truss in 2022, which cost her her position.

Business and market reactions

Within two weeks before the tariffs announcement, investors had already withdrawn over $25 billion from American funds. After Trump's statement, the situation only worsened. J.P. Morgan analysts increased the likelihood of a recession in the US to 60%, Deutsche Bank lowered its economic growth forecast, and other banks expect inflationary pressure.

It is anticipated that the Federal Reserve System will be forced to intervene by lowering interest rates to support the economy.

Business about tariff chaos

Companies are in a state of shock. PIMCO Chief Investment Officer Den Ivaschin called the new tariffs a “material shock to the global economy.” “We may be entering a period where policy governs the economy, rather than the other way around,” he emphasized.

Gary Friedman from RH stated that their company relies heavily on imports from Asia, and therefore tariffs will painfully impact the business. Other top managers also acknowledge that the situation changes by the hour, creating chaos in planning.

International reaction

Other countries responded instantly to the US decision. China has already imposed a 34% retaliation, Canada introduced its own tariffs, and the European Union is preparing for decisive actions.

"Even well-coordinated tariffs look too high under the new conditions," — said Adam Hettes from Janus Henderson Investors.

$5 trillion in losses

In two days of sell-offs, more than $5 trillion in market value of companies from the S&P 500 index was wiped out. This is one of the largest losses in Wall Street history.

Despite optimistic statements from the president, the market shows no signs of stabilization. "My policy will never change," — Trump wrote on social media.

What’s next?

Although history shows that even the worst crashes pass, today businesses and consumers are restraining activity. They are waiting for stabilization or a change in course.

"I'm not sure that the current situation adds confidence to companies," — summarized Liz Ann Sonders from Charles Schwab. — "Rather, it only deepens uncertainty."

10.04.2025

Economics

162

Industrial Tsunami: China Launches a New Wave of Expansion in Global Export

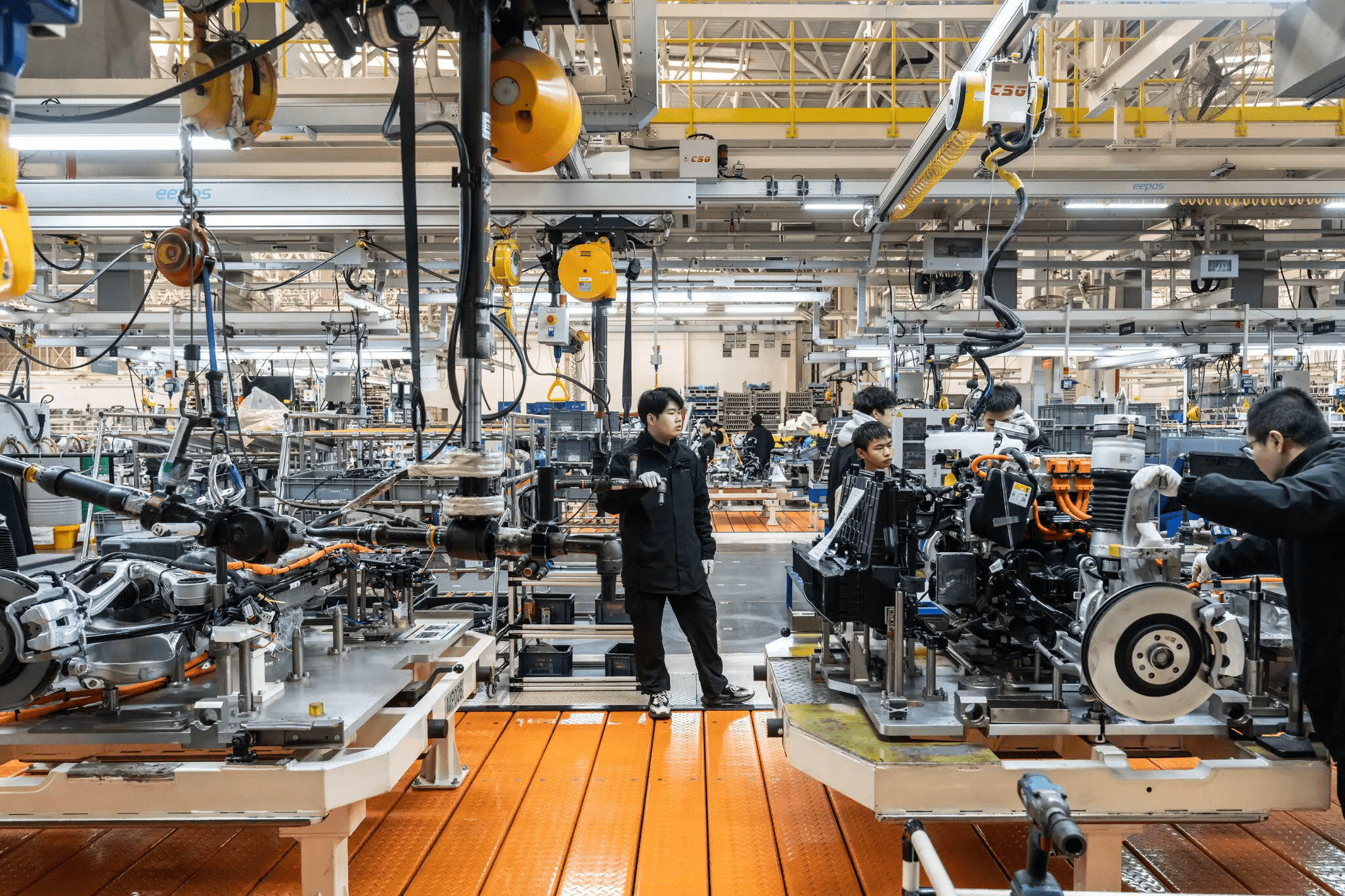

The world is facing a new economic threat – not a recession or financial crisis, but a super-powered wave of Chinese exports. Over the past four years, Chinese state banks have directed $1.9 trillion into industrial enterprise financing. These funds have become fuel for building new factories, modernizing production, mass automation, and rapid export growth, which are already impacting global markets.

Instead of skyscrapers dominating cityscapes before the housing market crash, today on the outskirts of Chinese cities, factories equipped with robots are rising. China is not only increasing production volumes – it is investing in research, development, artificial intelligence, and its own industrial know-how.

BYD, Zeekr, and Huawei — symbols of a new industrial era

The electric vehicle giant BYD is building factories that surpass the scale of Volkswagen’s former largest car plant in Wolfsburg. While Zeekr installs hundreds of new robots in its production facilities, Huawei is opening a research center in Shanghai with 35,000 engineers — ten times the size of Google’s headquarters.

It’s no surprise that China’s exports in 2023 increased by 13.3%, and in 2024 — by another 17.3%. These figures are impressive and simultaneously alarming — because such growth is achieved through significant government subsidies, dumping, and low domestic demand.

World reaction: tariffs, panic, and searching for solutions

Countries are reacting ambiguously. The European Union, the USA, Brazil, and Indonesia are introducing or strengthening customs restrictions. President Trump announced a new series of high tariffs, causing stock markets in Asia to fall. Chinese television responded with a harsh statement against the "hegemonistic economic policy of the USA".

However, history does not repeat literally. This time, Chinese companies blocked from the American market are actively expanding into new territories. For example, the share of Chinese cars in Mexico increased from 0.3% in 2017 to over 20% in 2024. Meanwhile, China is expanding its petrochemical production and exports of plastics, tires, polyester, and other industrial goods.

The Chinese model: cheaper, faster, larger-scale

China applies a unique development model: when domestic demand weakens, it is replaced by exports. After the housing market collapse, authorities redirected credit from apartment construction to industrial production. The decline in domestic consumption is compensated by export stimulation, allowing millions of jobs to be maintained.

However, problems remain. The social protection system is extremely weak — the state pension amounts to only $20 per month after a recent "increase" of three dollars. Economists are calling for the government to strengthen the domestic market through raising social standards. But Beijing currently prefers new investments in logistics, infrastructure, and factory modernization.

Is the world ready for a new industrial leader?

China already controls over 32% of global industrial production, leaving behind the USA, Germany, Japan, South Korea, and the United Kingdom combined. And this percentage is growing every month.

The question remains open: can the world withstand such scale of economic expansion? Will small and medium-sized producers survive the competition? And will leaders of the democratic world find effective and balanced responses that do not lead to new global conflicts?

09.04.2025

Economics

268

Tariffs on Everything: How Trump's Tariffs Will Affect Everyday Life

New tariffs imposed by President Donald Trump are causing serious concern among economists and consumers about potential rising food prices in the USA. Particular worry is raised by the situation with imported goods — especially those that spoil quickly and constitute a significant part of Americans' daily diet.

What is already known

It is too early to precisely assess how tariffs will affect supermarket shelves. However, experts already warn: it is most likely that the first to see price increases will be the products the United States imports — for example, avocados, pineapples, bananas, coffee.

“I think the prices for all those products we import will rise, — said Jeff Ramson from PCG Advisory Group. — At least in the near future. How much exactly — it's hard to say, but I would expect it to be significant.”

According to data from the U.S. Department of Agriculture, the country imports more food products than it exports. Goods such as avocados and tomatoes from Mexico, bananas from Costa Rica, coffee from Colombia — all of these could become considerably more expensive in the near future.

Why is this important

The White House forecasts an annual revenue of up to $100 billion from the new tariffs, and President Trump believes these tariffs will “ensure the nation's salvation.” However, falling consumer confidence and a stock market crash suggest otherwise: the public and markets fear serious economic consequences.

Economists warn: the ultimate burden of tariffs will be passed on to the consumer — through higher prices for food, automobiles, construction materials, and household goods. Company profits may decrease, and economic growth could slow down. Trump, however, insists that the new tariffs will stimulate the creation of factories in the USA, but admits that this may take at least three years.

The trade war in action

On Thursday, the Dow, S&P 500, and Nasdaq stock indices experienced their most significant drop in recent months — amid the tariffs announced by Trump against China, Japan, India, and the European Union. The president described the new tariffs as part of a plan to reduce the USA’s dependence on foreign goods.

In response, on Friday, China announced a 34% tariff on all American imports — mirroring the USA's actions. This step only exacerbates the already tense situation in global trade.

08.04.2025

Economics

479

Europe Will Respond: Brussels Prepares Steps in Response to Trump's Tariffs

The formula used by U.S. President Donald Trump to calculate his trade tariffs has puzzled many. Some even suggested that it was developed by artificial intelligence; however, economists believe that the formula itself looks like complete nonsense.

New tariffs and their consequences

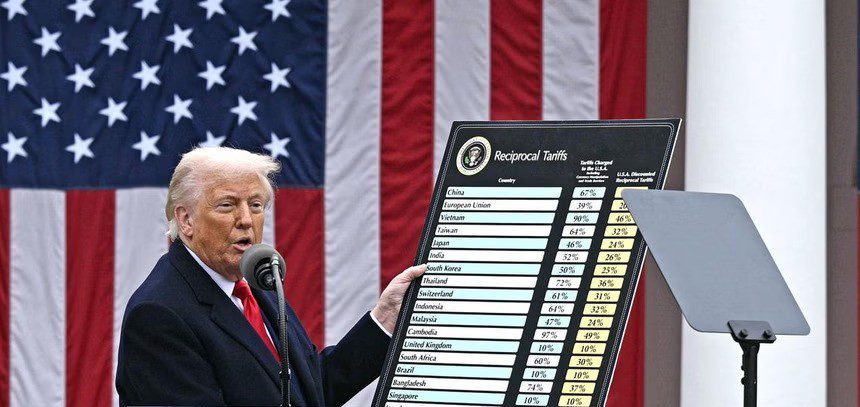

Trump introduced a 10% basic tariff on all imports to the USA, including islands inhabited only by animals. At the same time, some countries received even higher rates — supposedly in response to tariffs they impose on American goods.

These actions caused panic in international financial markets. Asian and Australian stock exchanges recorded declines for the second consecutive day, and American markets closed with the largest one-day loss since the COVID-19 crisis in 2020. Leaders from Beijing to Brussels have already pledged to respond to these tariffs.

The formula that raised doubts

When Trump published his list of tariffs, many economists questioned the validity of the formula used to calculate them.

The formula published by the White House

Former financial commentator for The New Yorker, James Surovetsky, stated that the calculation method looks as if it was “hastily written on the back of an envelope,” according to Politico.

"Incredible nonsense"

Surovetsky noted that the White House did not account for tariff rates and non-tariff barriers, contrary to what was claimed. Instead, for each country, the Trump administration simply took the US trade deficit with that country and divided it by the country's export volume to America.

For example, regarding the EU, Trump’s team took the US trade deficit with the European Union at $235.6 billion and divided it by European exports to the USA, which totaled $605.8 billion.

The result was a coefficient of 39%, which the Trump administration interpreted as an "unfair" advantage of the EU over the US. Consequently, the White House decided to impose a 20% tariff to "level the playing field."

Reaction to the new tariffs

Speaking at the Rose Garden of the White House, Trump stated that he was "kind" for nearly halving the tariff rate. He also claimed that the "market will thrive" after the new tariffs are introduced. However, stock indexes Dow Jones, Nasdaq, and S&P showed a sharp decline the following day.

Washington argues that its new tariffs, developed by the Council of Economic Advisors, take into account trade barriers, import elasticity, and tariff rates. However, according to the World Trade Organization, the figure calculated by the White House at 39% is more than ten times higher than the actual average trade-weighted tariff of the EU, which is 2.7%.

Europe prepares a response

In Europe, there is active discussion about Trump's new tariff policy. European Commission President Ursula von der Leyen stated that the EU is ready to take countermeasures but remains open to negotiations.

04.04.2025

Economics

480

Global Trade War: Why Is Trump Bypassing Russia?

Global Tariff Offensive by the US

US President Donald Trump launched a large-scale trade war by imposing tariffs on imports from most countries worldwide. On April 2nd, the day which Trump proudly called the "Day of Liberation," he announced a new economic policy aimed at “protecting American independence.”

From now on, imported goods into the US will have a basic tariff of 10%, with even higher rates for the "worst offenders." The hardest hit will be China (34%), the European Union (20%), Japan (24%), and India (26%). At the same time, Canada and Mexico received special regimes, and Russia was completely excluded from the new tariffs.

Why is Russia not under Trump's sanctions?

Surprisingly, Russia is absent from the list of countries against which tariffs have been imposed. The White House officially explains this by noting that other sanctions already apply to Russia, which “significantly restrict” trade. However, the US continues to purchase certain goods from Russia, raising questions among economists and politicians.

Some experts suggest that the Trump administration wants to preserve some leverage in relations with the Kremlin. Others believe this is another signal that the US may reconsider its sanctions policy toward Moscow.

How will this affect Ukraine?

Ukraine received a minimal basic tariff of 10%, which is not a catastrophic decision for our economy. Our exports to the US are modest — less than 2% of the country's total exports. However, tariff increases could impact Ukrainian steel products and the agricultural sector, as tariffs on steel and aluminum are already at 25%.

At the same time, new customs restrictions may open opportunities for Ukraine in Europe and Asia, as countries affected by American tariffs may seek alternative trading partners.

Consequences for the global economy

The introduction of tariffs will inevitably provoke reactions from the European Union, China, and other countries. Countermeasures are already being discussed, which could limit American exports to these nations.

Economists warn that the US’s new policy may trigger a global economic slowdown. Trade wars have historically proven ineffective, notably during the Great Depression of the 1930s.

What’s next?

The Trump administration has already indicated it is willing to negotiate with countries wishing to change their customs regimes. However, experts remind that even after signing trade agreements in the past, Trump has reinstated tariffs, changing conditions to his advantage.

Thus, the world is entering an era of new trade instability, where the global economy could become a bargaining chip in the political games of the world's most powerful countries.

03.04.2025

Economics

366

New Agreement with the USA: Economic Breakthrough or Threat to Sovereignty?

The administration of the U.S. president Donald Trump has proposed a comprehensive economic agreement to Ukraine, but Kyiv seeks to make significant amendments to its provisions. Ukraine’s main demand is an increase in American investments, as well as aligning the agreement with the country's European aspirations.

Discussion of the agreement details

On Friday, March 28, Ukrainian officials held a video conference with their American counterparts and legal experts to carefully review a nearly 60-page draft of the document.

One of the key issues discussed was a potential conflict of interest between the agreement and Ukraine’s plans for European integration. The American side did not rule out the possibility of changes, indicating some flexibility in the negotiations.

Criticism and lack of security guarantees

Despite prospects for economic cooperation, Ukrainian opposition deputies criticized the draft agreement, as it does not provide security guarantees for Ukraine. This issue is particularly important against the backdrop of the ongoing military conflict and the search for additional international support.

According to sources, the Ukrainian side will still prepare its proposals regarding amendments before sending them to Washington. The negotiations are expected to be long and complex.

Control over resources and strategic risks

One of the most debated points is a provision of the agreement that envisions broad U.S. control over investments in infrastructure and mineral extraction in Ukraine. This raises concerns among experts, as such a scenario could weaken the country's economic sovereignty.

The negotiations are ongoing, and Kyiv aims to achieve changes in the proposed agreement to protect its economic and geopolitical interests. Whether the parties can reach a compromise remains to be seen.

29.03.2025